Payments Insider 4th Quarter 2023

The inside scoop on payments for businesses of all sizes.

Remote Deposit Capture (RDC) is a deposit transaction delivery system that allows an organization to send deposit documents from remote locations via image-capturing software to the organization’s financial institution. An organization uses its financial institution’s RDC software, and a scanner connected to a computer at its on-site location or a mobile device, to take an image of the check. If you’re a corporate user of RDC services, there are multiple risks that you are responsible to mitigate. Mitigating these risks by implementing strong controls and procedures can ensure the safety and security of your organization, as well as aid in your financial institution’s risk management program. So, how do you introduce risk mitigation techniques? The first step is to educate staff on check basics, how to read a check, and how settlement occurs.

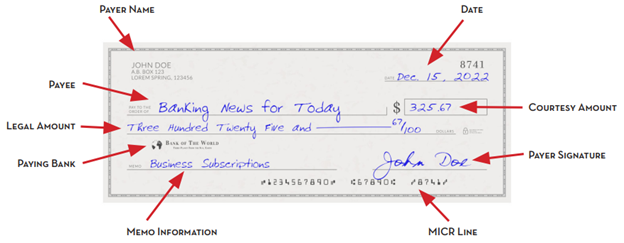

Here’s a breakdown of check lingo, what each term means, and where you can find the information on a check.

Although your financial institution may credit your account the same day or the next day after you make your check deposit, this doesn’t mean the checks have cleared settlement. Once your financial institution receives your deposit, they send those items/ check images to their operator, who receives the images and then the checks are dispersed to the respected paying institutions. The paying institutions post the checks, or, if the check is unable to be processed, return the check back to your depositary institution. Depending on your financial institution’s policies and procedures, the actual settlement process of individual checks can take several days.

Understanding the risks associated with RDC processing will allow you and your staff to identify and implement risk mitigation techniques.

An organization utilizing RDC services should develop adequate policies and procedures that address the specific risks associated with RDC activity, including security procedures, monitoring system-generated reports, ongoing education, fraud monitoring, audit standards, and due diligence practices. Understanding RDC processing and how to identify, as well as mitigate, risks will ensure your organization is getting the most out of your services.

Interested in having expert eyes on your organization’s RDC program? Reach out to EPCOR at advisoryservices@epcor.org for more information and a free, no-obligation quote.

Faster payments provide greater convenience and efficiency for individuals and businesses by enabling the instant, or near-instant, transfer of funds. This speed helps in time-sensitive situations, such as paying bills, making urgent purchases or settling financial obligations promptly. This payment type also reduces reliance on traditional paper-based methods, like checks, which can be slow and cumbersome. By embracing electronic transfers, businesses can streamline their operations and reduce administrative costs.

According to the Faster Payments Council’s Faster Payments and Financial Inclusion whitepaper, when it comes to financial inclusion, faster payments also provide easier access to banking services for underserved populations. The ability to send and receive money quickly and securely enhances economic participation and supports economic growth. They also have the power to bolster the overall economy by improving cash flow and liquidity management. Businesses can better manage their working capital, optimize supply chains, and make informed investment decisions, ultimately driving economic productivity.

Faster payments include Same Day ACH, instant payments, and push-to-card options. The two instant payment options are The Clearing House’s RTP® Network and the Federal Reserve’s FedNow® Service. The two push-to-card options are Visa Direct and Mastercard Send.

Now, let’s look at what differentiates these faster payment options. The choice of a faster payment option depends on various factors and can vary based on individual preferences and specific requirements. Here are a few considerations to help you decide what’s right for your organization:

It’s important to assess these factors based on your specific needs and priorities. It’s also helpful to keep up with the latest developments in the payment industry to stay informed about new and emerging faster payment options.

And remember, your financial institution is your biggest cheerleader and will be there to help you along the way! Reach out to them and they will be happy to help you decide what is the right option for your organization and situation.

EPCOR is a not-for-profit payments association which provides payments expertise through education, advice and member representation. EPCOR assists banks, credit unions, thrifts and affiliated organizations in maintaining compliance, reducing risk and enhancing the overall operational efficiency of the payment systems. Through our affiliation with industry partners and other associations, EPCOR fosters and promotes improvement of the payments systems which are in the best interest of our members. For more information on EPCOR, visit www.epcor.org.

Our team of dedicated professionals are here to support you.