Market Outlook Newsletter 2nd Quarter 2025

Tariffs complicate growth, inflation, and policy—favoring balanced, flexible portfolios.

Rate cuts expected amid rising unemployment; bond funds offer liquidity, flexibility, and better rebalancing opportunities.

The private assets market continues to expand, providing investors with opportunities to diversify beyond traditional asset classes.

New tariff measures are reshaping the outlook for inflation, consumption, and wage growth, introducing fresh uncertainty into the economic landscape. These developments may affect the direction of interest rates and influence portfolio positioning in the months ahead.

As the team noted earlier this year, the biggest risks we evaluated for capital markets were the magnitude and impact of trade and tax policy. The recent announcement by the Trump administration regarding “retaliatory tariffs” has provided some added clarity to the trade side of the risk equation. These tariffs, essentially taxes on imported goods, are intended to protect domestic industries by increasing the cost of foreign products.

![]()

Source: Wells Fargo Economics

As a result, consumers and businesses face higher prices for imported goods, which may, but not always, lead to inflationary trends, particularly in sectors heavily dependent on imported materials and components.

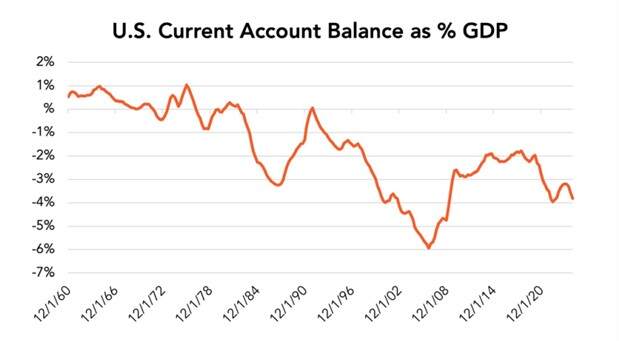

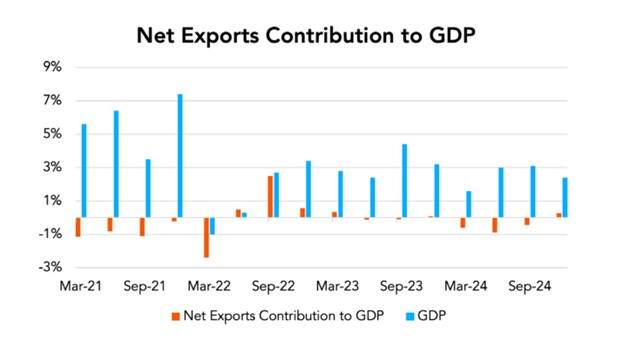

In the broader context of the U.S. trade balance, these tariffs play a crucial role. The trade balance, defined as the difference between the value of exports and imports, is a significant component of economic health and often expressed as a percentage of nominal Gross Domestic Product (GDP). By imposing tariffs, the administration aims to reduce the trade deficit by discouraging imports and potentially boosting domestic production. However, this approach can have mixed effects. While certain industries and jobs may benefit, it may also lead to higher prices and reduced consumption, which may dampen economic growth. Further, it’s unclear how the administration determined tariff levels, as charts shared with media appear to calculate the tariff rate based on the trade deficit as a proportion of a given country’s total U.S. exports.

Source: Bloomberg

While it’s still too early to assess the full effects on consumption, we analyze this environment through a framework that considers consumption, wage growth, productivity, and aggregate demand (a proxy for GDP). Tariffs, functioning like a supply shock in the absence of further escalation, may lead to higher initial prices, prompting consumers to seek lower-cost alternatives or delay purchases altogether. This potential contraction in consumer spending could ripple through the economy, slowing overall economic growth unless offset by a rise in wages or improved productivity.

On the other hand, tariffs may support domestic industries by shielding them from foreign competition, potentially increasing demand for domestic labor and leading to higher wages. While higher prices may temporarily reduce purchasing power and dampen aggregate demand, wage growth resulting from protectionist measures may help support or even increase demand, assuming there are no changes to the tax code.

Source: Bloomberg

The timing and magnitude of the tariff announcement prompt broader questions about its intended economic objectives. The U.S. Dollar has remained the world’s primary reserve currency for settling foreign trade since the early 1970s. Since the onset of global inflation in late 2021 and subsequent interest rate increases in developed markets, the dollar has remained strong relative to other major currencies.

Tariffs may lead to reduced demand for foreign currencies as imports decline, potentially leading to an appreciation of the dollar. However, if tariffs result in higher prices, the dollar’s purchasing power may weaken—a possible intended outcome, provided the dollar’s global role remains intact. Additional effects on investor sentiment and capital flows are likely, though harder to quantify.

Tariffs also influence interest rate expectations by affecting inflation and growth. Higher prices and inflationary pressures may prompt the Federal Reserve to raise interest rates to curb inflation. Conversely, if tariffs slow consumption and dampen economic growth, the Federal Reserve may adopt a more accommodative monetary policy, potentially lowering interest rates to stimulate the economy. At the time of writing, markets are pricing in three quarter-point rate cuts for the remainder of 2025. This is a departure from the one-and-a-half cuts expected earlier int the year, suggesting growing concerns about economic softness.

Earlier in the first quarter, the team adjusted our investment strategy by moving to a neutral weight in equities (moving fixed income from an underweight to a neutral weight in the process), and extending out fixed income duration.

The rationale was that the potential for increased volatility was not priced into equities, and fixed income offered a good cushion in terms of overall yields, despite tight corporate credit spreads. Bonds are expected to benefit from the Federal Reserve’s response to inflation and growth dynamics influenced by tariffs and may serve as a source of liquidity if conditions create an opportunity to lean more into equities.

The bottom line is that the tariffs levied by the Trump administration are likely to have multifaceted effects on the U.S. economy. While higher prices and reduced consumption could weigh on growth, wage gains in protected sectors may partially offset these effects. The ultimate impact on aggregate demand, the value of the dollar, and interest rates will depend on the complex interplay of these factors, absent a change in tax policy. As the economy adjusts to these new trade dynamics, close monitoring and analysis will be essential to understand their long-term implications. Meanwhile, our investment strategy prioritizes a multi-asset approach, with a focus on fixed income, to mitigate risks and capitalize on opportunities presented by changing rates.

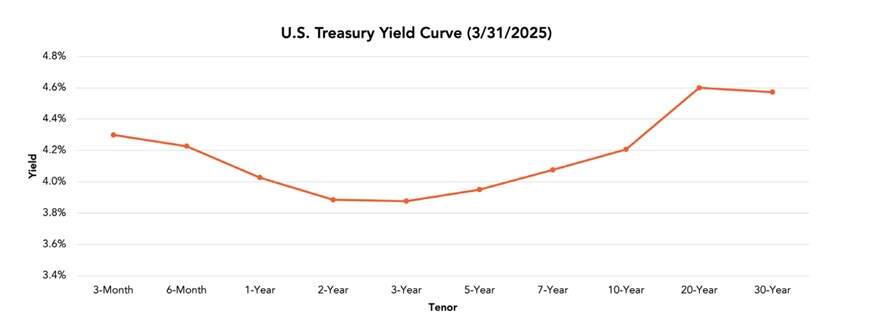

The Federal Reserve faces difficult decisions in 2025 as it attempts to balance its dual mandate of high employment and stable prices. As of the end of Q1, the fixed income market is positioned for short-term interest rates to be cut throughout the year, indicating the Fed’s focus may lean more toward maintaining a healthy job market.

After cutting the fed funds rate by 1.0% in 2024, the Federal Reserve maintained the current target rate in the range of 4.25% to 4.50% at their Federal Open Market Committee (FOMC) meetings in January and March. As we look ahead to the remainder of 2025, the Federal Reserve may find itself in a challenging position as it works to balance its dual mandate of full employment and stable prices (low inflation).

Year-over-year (YoY) inflation, as measured by the Consumer Price Index (CPI), has come down from the recent peak level of 9.1% in mid-2022. However, recent CPI data shows inflation continues to hover above their 2.0% target rate. If the tariffs announced in early 2025 remain throughout the year, we expect inflation to begin trending higher again as companies pass some of their higher costs to consumers. The difficulty for the Federal Reserve is that most inflation created by high tariff rates represents a one-time price adjustment likely to fade over time rather than an ongoing price shock. Also, if some tariffs are eventually rolled back, the prices of those goods may come back down.

If the Federal Reserve places more emphasis on its full employment mandate, the FOMC will likely reduce the fed funds rate this year. Through the first few months of 2025, the employment data shows that the monthly job growth trend has continued from last year. However, growing concerns suggest that federal layoff announcements and economic uncertainty from tariff policies may further elevate the unemployment rate in 2025. The unemployment rate has trended higher from 3.4% in April 2023 to 4.2% in March 2025, but that has been driven more by increasing labor force than it has from layoffs. If the unemployment rate continues to trend higher, there may be growing pressure for the FOMC to lower the fed funds rate to boost the economy, even if inflation numbers are increasing at the same time.

Source: Bloomberg

As of the end of March, the bond markets were pricing in around 0.75% of fed funds rate cuts by the end of 2025. That is why the U.S. Treasury (UST) rate curve is shaped like a “V” (shown in chart), with yields on USTs falling from 3-month to 3-year maturities, then rising again with longer- dated USTs. Our team continues to see more opportunities within the front and back end of the yield curve while minimizing exposure to bonds that mature in the 2- to 5-year timeframe where yields are the lowest.

When our team has initial conversations with clients, it often feels natural to focus on determining the correct equity allocation since that is where most of the short-term volatility within a diversified portfolio comes from. However, an appropriate allocation to fixed income is equally important. We view the role of fixed income to provide stability, liquidity, and diversification from equities within our strategies.

Too much fixed income exposure may yield insufficient returns to meet financial goals. If clients do not have enough exposure to fixed income, they may risk being forced to sell equities at inopportune times to generate cash flow, which may also significantly impact portfolio returns.

While purchasing individual bonds may be suitable in certain situations, there can be significant tradeoffs to consider relative to utilizing fixed income ETFs and mutual funds. We believe bond funds may offer more advantages for most clients. First, the bond funds typically provide more liquidity for cash needs from the portfolio. Second, with a constantly changing bond market, we can be more nimble and target fixed income segments that are difficult to access through individual securities, such as mortgage- backed securities or collateralized loan obligations (CLOs). Lastly, bond funds allow for more efficient portfolio rebalancing when financial markets are dislocated, which may result in higher portfolio returns in the long term.

With volatility rising and traditional assets under pressure, private markets continue to offer compelling diversification benefits. From the inflation-hedging potential of infrastructure to the long-term growth opportunities in private equity, these alternative assets play an increasingly important part of modern portfolios.

2025 has certainly tested investors’ resolve, as volatility has returned with force. The CBOE Volatility Index (VIX), which measures market expectations of near-term volatility, spiked more than 30% in a single day. U.S. equities have posted some of their worst daily returns since COVID-19, rattled by new tariffs and growing uncertainty around global trade. Inflation remains persistently above the Fed’s 2% target. The announcement of a 10% baseline tariff on goods from 60 countries has reignited concerns about inflationary pressures not seen in recent years. Meanwhile, additional interest rate hikes from the Fed, intended to cool demand and control inflation, have added to broader market uncertainty.

While international equities and U.S. Treasuries have shown some relative strength in recent weeks, early signs of stress are emerging elsewhere. Credit spreads in fixed income markets are beginning to widen, albeit modestly. Against this backdrop, many investors are asking which asset class might offer durability across economic cycles—and stand the test of time.

Private infrastructure may be part of the answer.

Often an overlooked asset class but one that clients resonate with most, private infrastructure refers to essential physical assets, such as transportation networks, the energy grid, or digital infrastructure. It’s the physical foundation needed for a society or enterprise to operate. Due to the highly capital-intensive nature of these projects, most are undertaken by public works. However, in recent years, more and more private companies have become larger players in these arenas.

Private infrastructure offers a range of compelling benefits for investors seeking portfolio stability and long-term growth. As a diversifier, it exhibits a low correlation to traditional public market asset classes, including other real assets like real estate, which helps to reduce overall portfolio volatility. Its capital preservation characteristics stem from the essential nature of infrastructure. Assets such as roads, cell towers, and fiber optic networks remain in constant use regardless of economic cycles. Many operate in monopolistic environments with stable demand. Additionally, infrastructure may serve as an effective inflation hedge, as many contracts tied to these assets include provisions for periodic price increases, especially valuable during inflationary periods like 2022 to the present. Investors also benefit from consistent cash distributions, as these assets often generate reliable, contractually backed income streams. Beyond steady cash flow, private infrastructure offers upside potential through asset appreciation, particularly in sectors aligned with long-term secular trends such as digitalization and decarbonization, making it a strategic addition to a diversified portfolio.

But the asset class doesn’t come without its risks. In the last quarterly report, we touched on the liquidity risks, as liquidity may vary depending on the vehicle used to gain access to private infrastructure. But outside of redemptions, there are other risks worth noting. While most projects are privately funded, some still depend on government funding, subsidies, and policies. Changes in the legislative landscape can dramatically affect project timelines, financing, and management. Likewise, infrastructure projects and their valuations are closely linked to interest rates. Unlike public markets, where real-time trading drives valuations, private markets are more closely tied to appraisals, which may be influenced by interest rate movements.

Source: Prof. Jay Ritter, University of Florida, Warrington College of Business

In a year marked by uncertainty and rapid change, private infrastructure stands out as a durable and strategically relevant asset class. Its vitality, inflation-linked income potential, and long-term growth position it as a powerful complement to traditional portfolios, especially when markets are swinging and confidence is in short supply. Yes, it comes with trade-offs, such as illiquidity, regulatory complexity, and interest rate sensitivity, which must be weighed carefully. However, for investors seeking stability without sacrificing upside, private infrastructure offers a rare combination of resilience and return potential. In many ways, it’s an old-world asset class built for the challenges of a new world economy.

Private equity often comes with a reputation that may feel controversial. The common perception is that firms acquire undervalued public companies, strip them down, sell the parts, and walk away with a profit. While such strategies exist, they no longer reflect the reality of most private equity activity today. More often, these firms act as true owner-operators, acquiring companies intending to improve operations, inject capital, and position them for long-term growth. The goal is to sell to a strategic buyer or take the business public when it has grown appropriately and has a more proven track record.

In simple terms, private equity is like buying stock in a company, except the company is not publicly traded. PE firms raise capital from institutional investors, financial institutions, and high-net-worth individuals and deploy it into private businesses over a set investment period. They aim to grow revenue, improve profitability, and increase the company’s overall value. Just as public markets have small-, mid-, and large-cap stocks, private equity spans a range of strategies, from high-risk venture capital in early-stage startups to growth equity in established firms and buyouts of mature businesses.

This private-market approach has become increasingly attractive, not just for investors but also for the companies themselves. More and more firms are choosing to remain private for longer or avoid the public markets altogether. The question is: why? What’s driving the shift away from IPOs and toward private capital as the primary growth engine?

Between 1984 and 2004, the U.S. averaged just under 300 IPOs annually. Over the past two decades, that number has dropped sharply to around 120 annually. The shift is even more pronounced when you consider company size: nearly 85% of firms with $250 million or more in revenue remain private today, compared to the minority that is publicly traded. Going public was once seen as a milestone, a symbol of success and validation for CEOs. But with public ownership came new pressures: increased scrutiny, quarterly earnings calls, and the constant risk of stock price swings driven by short-term sentiment. For many leaders, this environment created a tension between delivering long-term strategic value and meeting near-term market expectations. As a result, many companies are not avoiding the public markets altogether but simply waiting longer. The average market value of firms going public between 1984 and 2004 was around $200 million; over the past 20 years, that figure has more than doubled to $500 million, reflecting a preference to grow larger and more stable before stepping into the spotlight. Staying private allows companies to focus on scaling, refining their business models, and building sustainable value, often under the guidance of private equity firms with 5- to 7-year investment horizons or company insiders more concerned with strategic progress than quarterly earnings beats.

The evolving role of private equity and the growing trend of companies staying private longer reshape how value is created and accessed in today’s market. For investors, this shift underscores the importance of looking beyond public markets to capture the full spectrum of opportunity. Many of the most innovative, fast-growing, and operationally sound companies are now staying private during their most transformative years. By gaining exposure to private equity, investors may participate in that value creation earlier in the lifecycle, well before a company ever rings the bell on Wall Street. In a world where public markets increasingly reflect the end of the growth journey rather than the beginning, private equity offers a powerful way to stay aligned with the engine of long-term economic progress.

Our team of dedicated professionals are here to support you.