Market Outlook Newsletter

1st Quarter 2023

By Betsy Pierson, CFA

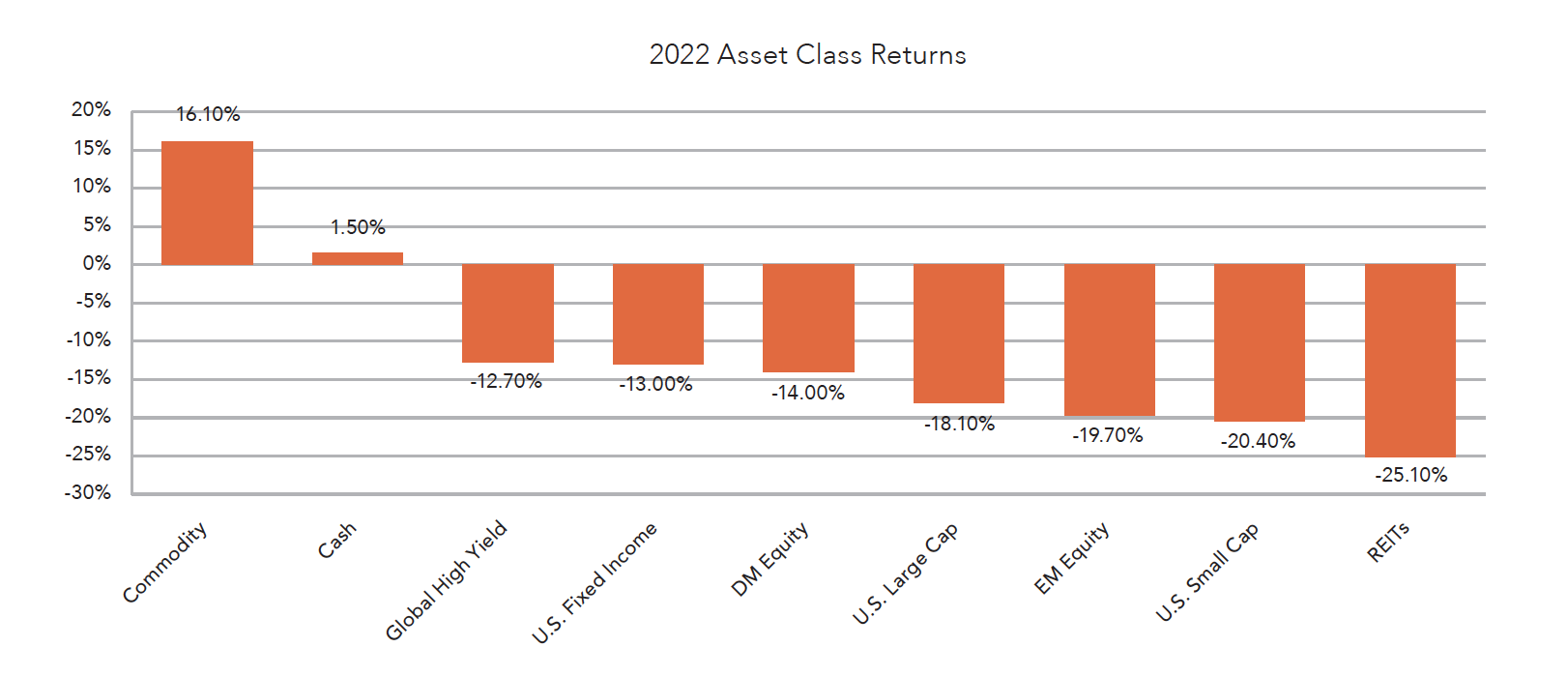

This last year has certainly been a challenging one for investors. There were few places to hide unless you were invested in commodities or cash. 2022 will go down in history as one of the worst years for the 60% equity/40% bond investor with double-digit negative returns. The S&P 500 index return was the lowest since 2008 and bond returns, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, were the lowest since its inception in 1976. Moving from a zero-interest policy to an aggressive rate-hiking cycle weighed heavily on fixed income returns and bled over into the equity markets.

One year does not make a trend, especially considering that interest rates are now back to levels we have not seen in a decade. Over the last year, the dramatic increase in rates led to lower prices on bonds with no income to offset the price movement, which resulted in a negative total return. The yields now available on bonds can protect on the downside where they could not in 2022, assuming interest rates increase gradually. Also, while the Federal Reserve (Fed) is still leaning towards more interest rate hikes, it is 85% to 90% complete barring any dramatic increases in the inflation rate. Looking at it from this viewpoint, if interest rates remain stable, the fixed income component in the 60/40 portfolio should provide an estimated return of 4%*. This will vary depending on the direction of interest rates, but we do not anticipate negative fixed income returns in 2023. Regarding the equity portion of the portfolio, there may still be pressure on returns during 2023 as we move through this Fed tightening cycle and the business cycle. However, historically since 1926, equities have returned 10% on average. While many pundits do not believe that this will play out in the future, if you look at the average annual return of the S&P 500 over the last 3-year, 5-year, 10-year, and even 30-year period, the return is close to 10% annually despite the market ups and downs.

All inflation numbers indicate that it peaked sometime during summer. The Consumer Price Index (CPI) peaked at 9.1% year over year in June and declined to 7.1% year over year in November. The Core CPI (excluding food and energy) peaked in September at 6.6% year over year and most recently was at 6% year over year. While the numbers are nowhere near the Fed’s 2% target rate, the trend is moving in the right direction. If you look at CPI annualized in the last 3 months, the rate is less than 4%, and there has been little inflation since it spiked in May and June. As mentioned in our last outlook, money supply growth has declined dramatically and was negative in the most recent release. Money supply growth leads inflation by about 18 months and has been declining rapidly since its peak in 2021. Inflation is following according to the norm and has rolled over on cue. If this trend continues, the inflation rate will be close to the Fed target within the next six to nine months. Of course, this does not mean that prices will decline from current levels but will not increase substantially more. If this follows course, the Fed will slow down or even pause the tightening cycle by mid-2023, if not earlier.

Whether there is a soft landing or a recession, economic growth will be slower than in the last two quarters of 2022. The second half of 2022 grew at greater than a 2% annualized rate. Several economic and market indicators lead us to believe there will be a recessionary period sometime in mid-2023. The inverted yield curve, including but not limited to the 3-month to 10-year Treasury, became inverted in mid-October and continues to maintain that position. The leading economic indicators have been negative for the last nine months and over the last 60 years, which have historically led to a recessionary period. While no indicator is 100% accurate in predicting a recession, there are many signs that the U.S. will enter a recession sometime in the next six months. Economic activity has slowed, especially in the housing market. Higher interest rates have made homes less affordable due to the higher monthly mortgage payments. While many of us remember rates at 6% levels, there is a whole generation that has not experienced mortgage rates above 5%. In addition to homes being less affordable, current homeowners with 2.5% mortgage rates are hesitant to sell and move up to a 6% or higher mortgage. As a result, home prices are declining in many markets, which was one of the Fed’s goals with the aggressive rate hikes. The labor market continues to be one area that has not shown strong signs of easing, but the labor market is a lagging indicator and is typically the last to fall. Regarding the labor market, there continue to be more job openings than unemployed persons, but the number is slowly tightening. There have been announcements of layoffs at several large companies that hired extensively following the pandemic. In a normal recession, job losses mount and the unemployment rate increases. While the unemployment rate may increase in this potential recession, it may not rise as dramatically since many mid- and small- businesses never reached full employment following the pandemic. The labor market mix has changed. The baby boomers are retiring, and new job entrants are not as great as in past recessionary periods. If we have a recession, it does not appear that it will be a deep and long recession like the Great Financial Crisis in 2007-2009. Consumer and business balance sheets are in decent shape, many of the market excesses have been washed out this year, and the supply chain issues that are still working themselves out will help balance the excess usually experienced in recessionary periods.

As a long-term investor, there are always risks that will impact markets year to year. The negative returns experienced in 2022 were dramatic and painful. Until this past year, there had not been a true bear market in stocks since March 2009. Fixed income never had a bear market like this past year. Typically, equity bear markets last 18 to 24 months but can be shorter or longer. Looking at where we are in the market cycle, equity markets could continue to experience volatility and potential negative returns over the near term, but market timing is exceedingly difficult to achieve. As a long-term investor, the opportunities in both fixed income and equities are greater today than a year ago. Investing in the appropriate allocation for individual risk tolerance, staying the course, and remaining invested will benefit investors despite the short-term risks.

It is extremely important for investors to take a step back during these volatile times and remind themselves of their long-term goals. Investing in an appropriate investment allocation is the long-term driver of returns, and a diversified portfolio of bonds, stocks, and alternatives is appropriate.

Fixed income investments and interest rates are rarely hot topics to discuss. However, 2022 was different. Interest rates continued to be discussed and closely watched throughout the year and constantly made headline news.

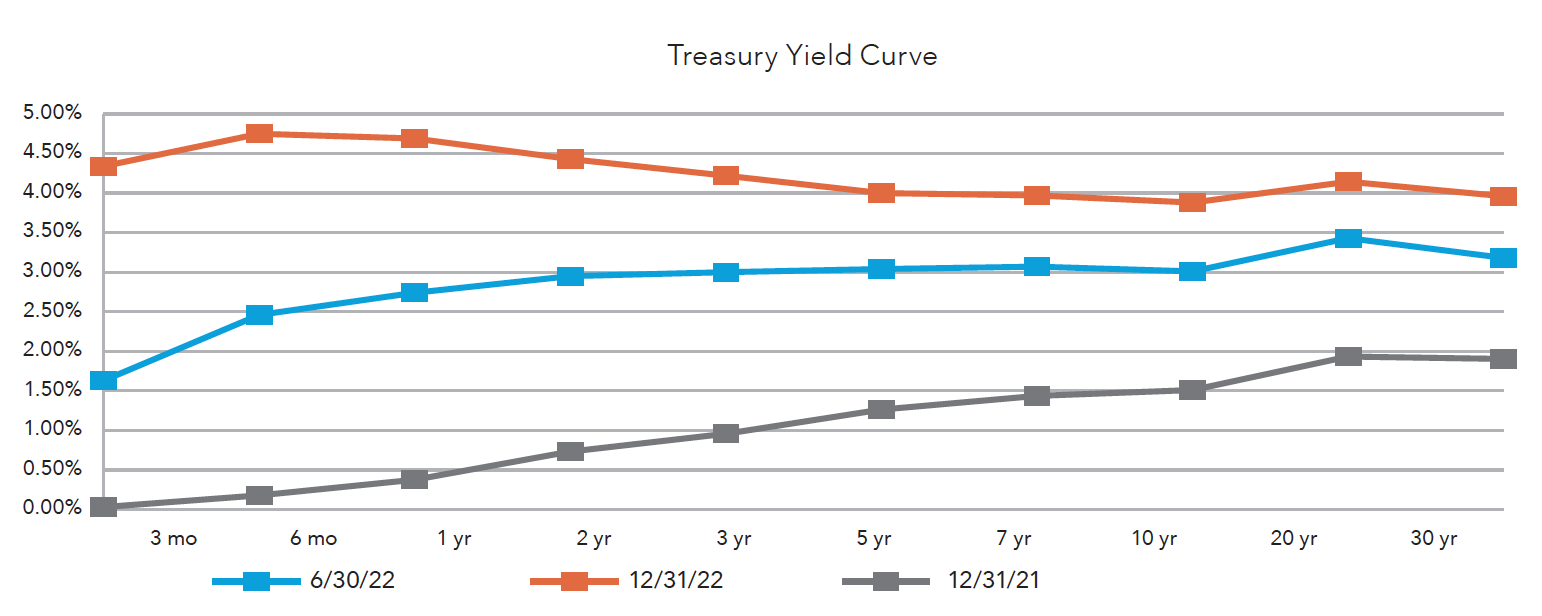

In total, the Fed raised interest rates seven consecutive times during the year for a total increase of 4.25%. Interest rates are back to levels not seen since 2007-2008. The first rate increase was in March, less than one year ago. It is hard to remember, but 2022 started with interest rates near zero. We are now in a more normalized interest rate environment.

In addition, continued rate increases are expected this year, but most of the tightening is behind us. Rates are projected to increase 75 basis points, or 0.75%, throughout 2023. The reality of rate increases this year will heavily depend on inflation data and the labor market.

Our investment strategy committee will continue to review and monitor the current investment environment and will pay close attention to the Fed statements. Its first meeting of the year will conclude on February 1.

The federal funds rate is currently 4.25%-4.50%. Again, the consensus estimate is for this rate to reach 5-5.25% before the Fed will pause. Lowering inflation continues to be the motive behind raising interest rates, and there has been progress on that front. As mentioned above, headline CPI inflation has eased from a peak of 9.1% year over year to the most recent reading of 7.1%.

“We welcome these better inflation reports for the last two months, but we’re realistic about the broader project,” Chairman Powell said. “It will take substantially more evidence to have confidence that inflation is on a sustained downward path.”

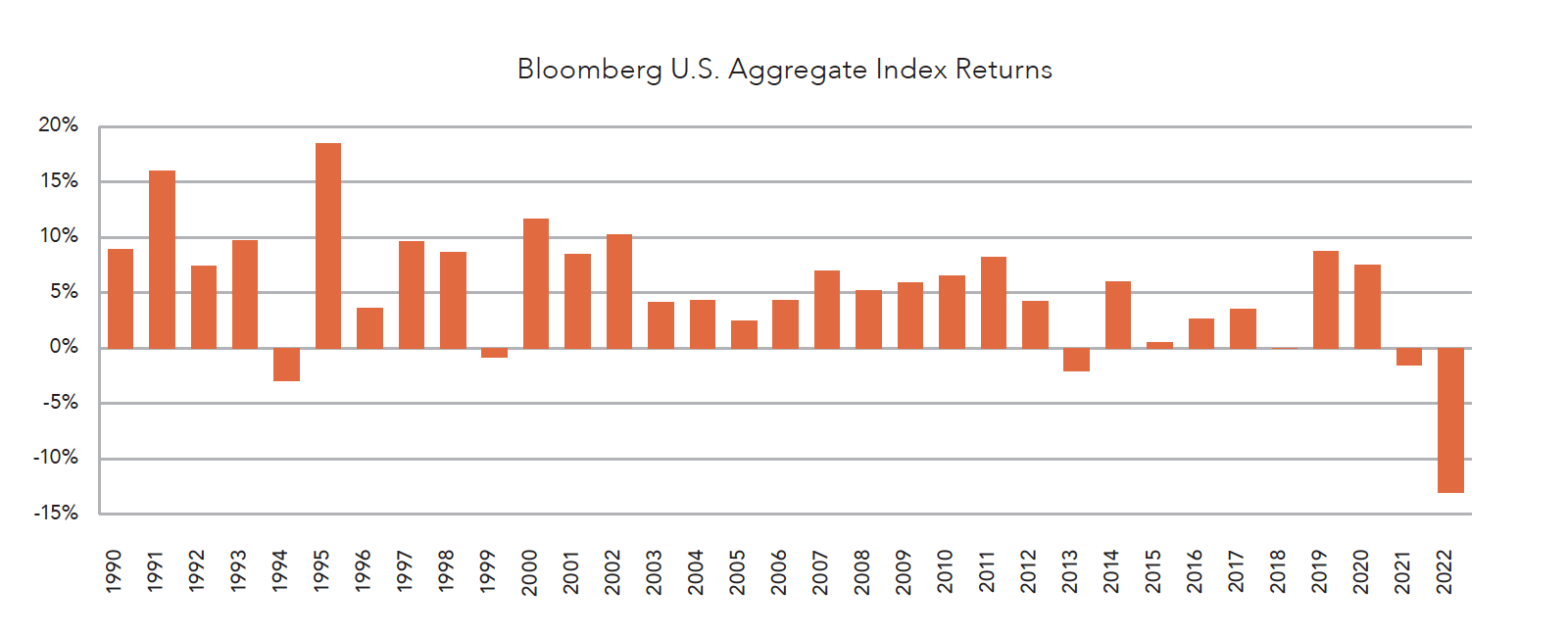

The bad news to rising interest rates: negative fixed income performance. These negative numbers could be remembered as a historical outlier and the worst year on record! The Bloomberg Barclays U.S. Aggregate Bond Index, which is representative of the U.S. bond market, will also make history for doing something it’s never done before: lose value for the second year in a row. 2022 fixed income performance:

I want to reiterate just how awful these fixed income returns are. Please see the chart below. It is unusual for fixed income to have a negative annual return, but the return we just experienced was a dramatic drop! The investment strategy committee made several strategic adjustments to fixed income throughout the year and utilized losses to offset gains. The 2023 fixed income outlook is not expected to be a repeat of 2022.

The good news to rising interest rates: fixed income investments are now better positioned to provide steady, reliable, low-risk income and returns to portfolios. For the first time in nearly 15 years, bond yields are supporting retirees by yielding enough to cover a 4% withdrawal rate. Our client portfolios are fully invested, and for most investment objectives, this means an allocation to fixed income. Investors may feel let down by the poor performance fixed income had last year, but again, fixed income still deserves a place in almost all portfolios.

The 10-year Treasury yield, which influences rates on mortgages and other loans, began the year around 1.52%, peaked in October at around 4.25%, and ended the year at 3.88%. Shorter-term rates had an even more dramatic move higher, with the 2-year Treasury yield starting the year around 0.78% and ending the year at 4.41%.

The yield curve is fully inverted, which is an ominous sign for the economy. We are still in a rate hike cycle, and it is easy to be pessimistic about 2023. However, a long-term investment strategy and continued conversations about goals and asset allocation should remain the focus.

As interest rates have moved higher, savings and money market rates have also moved up substantially. In preparation for a bumpy 2023, building and maintaining an emergency fund should be a priority.

Our investment strategy committee will begin 2023 with an elevated cash position and will maintain an underweight to our fixed income position with a neutral duration target.

By Tracey Garst and Jake Stapleton

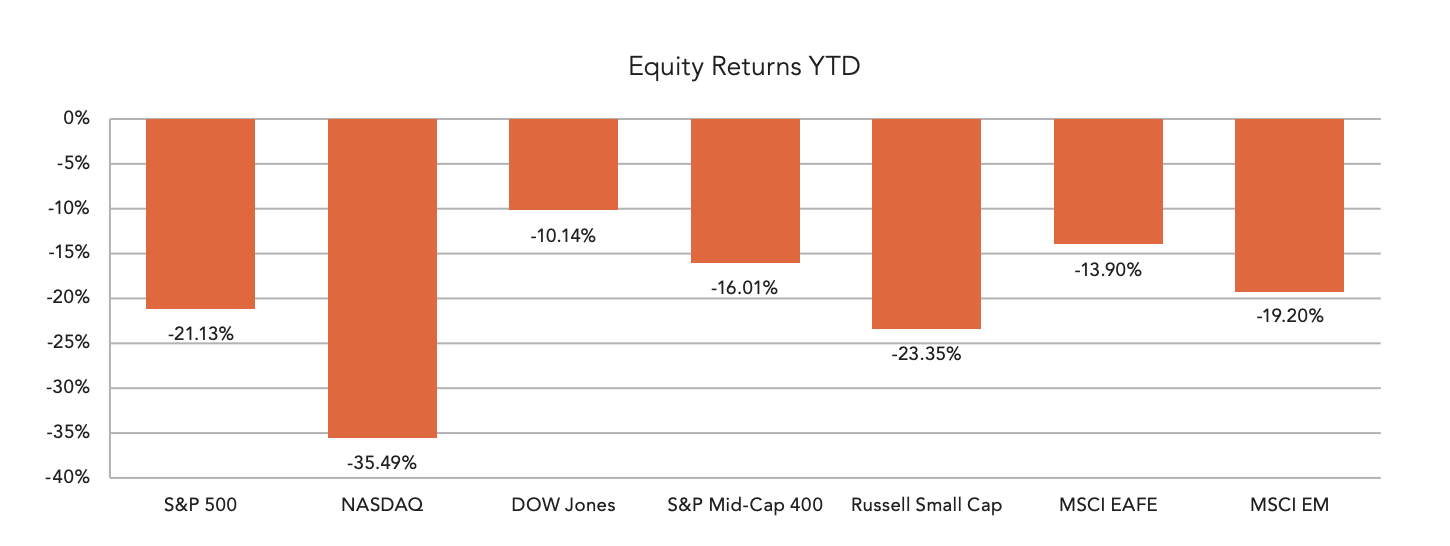

Brutal! That is the only description we can come up with to describe the 2022 market returns. Google defines the word brutal as savagely violent, which accurately describes the volatility we experienced throughout 2022. High and persistent inflation drove central banks to rapidly and significantly tighten financial conditions, threatening economic growth and corporate profits. This led to a valuation reset of global equities in 2022 with capital markets now pricing in a significant global economic slowdown. The key question is whether this deceleration will end in a soft landing with positive but slower growth or in a full-fledged recession that drags down earnings. Much depends on the Fed and the world’s other central banks as they continue efforts to bring inflation under control by hiking interest rates and draining liquidity from the markets.

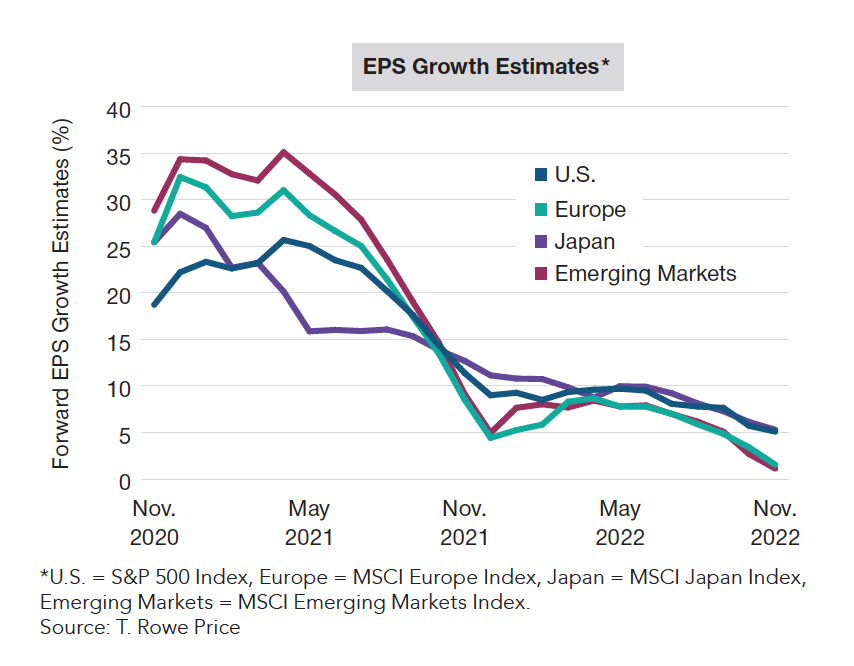

After a miserable 2022, valuations in most global equity markets have improved markedly, although U.S. equities still appear expensive relative to their history. Even with the geopolitical concerns facing several foreign economies, the MSCI EAFE International Index outperformed the tech-heavy S&P 500. Generally, when domestic equities return less than 4% for the year, developed international equities tend to outperform; and 2022 was no exception to that rule. Soaring bond yields largely drove equity bear markets in 2022 by compressing valuation multiples. However, in 2023, earnings growth could move to the top of the list of investor concerns.

Fourth quarter earnings are off to a rough start, setting the tone for what could be a weak start to the new year. The S&P 500 earnings growth rate is expected to decline -4.80% in the first quarter of 2023 and -5.44% in the second quarter of 2023 according to Hamilton Lane. This is a stark downward revision from the 2.87% and 0.88% posted on 9/1/2022. The overall earnings growth rate for the S&P 500 in 2023 is set to be 5.5%, 3% lower than the 10-year average.

Equity valuations continue to flat line. The Buffet Indicator (a measure of how overvalued vs. undervalued a security is) remains relatively high. The Buffet Indicator is calculated by taking the Wilshire 5000 Total Stock Market Index divided by the U.S. GDP, which puts it well above the 90th percentile average of 151%. This once again indicates that equity valuations are still relatively high. While still not close to the 2021 P/E high of 45, quarter four S&P 500 P/E ratios are hovering around the COVID-19 lows of 18-21; still a large 30% premium from the long-term average. Our primary concern is the current P/E multiple of 18-21 could be even higher if earnings estimates continue to fall, which will place added pressure on stocks.

As we enter 2023, we continue to maintain our cautious view on the equity markets. The war in Ukraine, China’s Covid-19 struggles, high inflation, and tighter monetary policy will all be relevant factors as we move through the new year. Global supply chains will continue to be reconfigured with less reliance on China. Unfortunately, moving manufacturing out of China will increase labor costs and likely supports stickier inflation going forward. Investors stand at a major turning point in capital market history. The global economy has moved from decades of declining interest rates into a new regime marked by persistent inflationary pressures and higher interest rates. The era of cheap money and high asset valuations is likely over.

As for valuations, small-cap stocks have taken a beating this year. Currently, small-cap valuations are at the lowest point since the 2000 tech bubble relative to large-cap stocks. The large-cap to small-cap index has remained relatively flat as of late. This could be an indication that small-cap stocks have been keeping up with the large-cap performance. The combination of the two could create a good buying opportunity for small-cap equities as we progress through the new year. We will be looking for an opportunity to increase our exposure to small-cap stocks at some point in 2023, which is why we are maintaining on overweight position in cash.

We believe 2023 will be the “tale of two markets.” We see the first half of the year being dictated by slower economic growth and weaker corporate fundamentals; namely declining earnings growth and weaker profit margins. This would then give way to a stronger second half as investor sentiment improves as we see an end to central bank tightening and continued improvement on the inflation front. As investment managers, we will have to balance the possibility of disappointing global growth against the backdrop of a central bank pivot, less volatility, and the potential of a return to growth later in the year. We expect 2023 to include recoveries and present opportunities with most central banks ending their tightening cycles; however, it will not come without volatility.

By Jeffrey Schmidt, JD

Trusts have been part of the estate planning conversation for over a thousand years and have become the primary estate planning vehicle in use today. The Trustee is charged with certain duties relative to their role. While being nominated may be an honor, serving as a Trustee carries risk and responsibilities.

A Trustee must serve in a Fiduciary capacity having certain duties. The Trustee must act on behalf of the beneficiaries of the Trust, always putting their interests ahead of the Trustee’s own. While seemingly straightforward, many individual Trustees have innocently breached this duty.

Loyalty to the Trust’s beneficiaries is a fundamental duty. A Trustee must avoid placing themselves in a position where they would benefit from an administrative action at the expense of the beneficiaries. This loyalty could be breached innocently by unknowingly influencing a beneficiary.

A trustee must also demonstrate impartiality by administering the Trust in a fair and reasonable manner that is unbiased with respect to the often-competing interests of all beneficiaries.

Balancing current ‘income’ beneficiaries pushing to skew the portfolio toward income-producing investments at the sacrifice of more growth-oriented holdings, which would be advantageous for remainder beneficiaries, can be challenging. A Trustee is tasked with making investment decisions that produce income and increase the value of the corpus of the Trust estate.

All qualified beneficiaries are entitled to sufficient information allowing them to be reasonably informed of the administration of the Trust and all material facts necessary to protect their respective interests. The Trustee must furnish that information confidentially.

Rendering a clear and accurate account at reasonable intervals, at least annually, is critical. Maintenance of clear, complete, and accurate books and records regarding the Trust property and the administration of the Trust is required.

The Trustee must take control of all property belonging to the Trust and preserve it. With real property, a Trustee is tasked with maintenance, repairs, taxes, insurance, etc. While a Trustee must preserve the property, there is no duty to improve it.

Regarding liquid assets, a trustee has an obligation to invest those assets in a manner that reflects what a ‘Prudent Investor’ would do. The purpose, terms, distribution requirements, and the totality of the circumstances surrounding the Trust must be considered. Tax considerations, diversification of the portfolio, and risk management are all part of the analysis. A Trustee may delegate investment functions to a qualified professional. However, with such a delegation, the Trustee must act prudently in the selection and is required to exercise an appropriate level of oversight after the delegation.

With certain trusts, the Trustee has additional specific administrative duties required to maintain the integrity of the Trust vehicle involved and to avoid vitiating the purpose of the Trust through mismanagement. For example, administering a Trust for the benefit of a disabled beneficiary may require knowledge of Special Needs Trusts and the interaction of various Social Security programs. Understanding the tax ramifications of a distribution from a Generation Skipping Trust and/or GST ‘exempt’ trust can help avoid mismanagement.

The Trustee must understand the terms of the Trust. Those not well-versed in the meaning of certain legal jargon will struggle to fulfill their duties.

Authority Recognition and resolving potential conflicts of interest can be difficult and prevalent when the Trustee is also one of the beneficiaries of the Trust. It is vital to fully understand the Trustee’s Fiduciary role and separate it from the Beneficiary role. These ‘two hats’ have very distinctive goals and duties.

Exercising discretionary authority over Trust assets is at the heart of being a fiduciary and can also be one area of potential liability for the Trustee. Where litigation has ensued, the Courts have repeatedly held that the Trustee should follow an established process for evaluating the issues surrounding any discretionary action. A Court will show deference to the Trustee’s decision if it was made per an established process and was properly documented. A Trustee electing to exercise discretionary authority in making a distribution to the ‘squeaky wheel’ without proper analysis or foundation, may result in a difficult defense of that exercise.

With a basic understanding of the job requirements, the first decision in the Trustee selection process is to choose between two broad categories of potential Trustees: an individual or a professional Corporate Trustee.

If you have any questions or need assistance with selecting your trustee, please do not hesitate to reach out to your relationship manager.

Our team of dedicated professionals are here to support you.