Market Outlook Newsletter 1st Quarter 2025

The new administration’s tax policies are uncertain, but Trump’s previous term offers some insights.

One-Year

S&P 500 +25.00%

MSCI EAFE +3.82%

The private assets market continues to expand, providing investors with opportunities to diversify beyond traditional asset classes.

By Noah Spencer

Tax and trade policies are likely the most significant macroeconomic unknowns in the coming year.

The relationship between trade and tax policy will shape the fiscal landscape in 2025. While predictions remain uncertain, insights from President Trump’s previous term offer clues about potential market impacts.

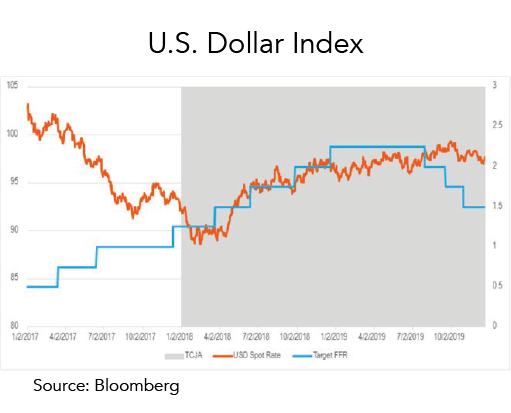

The 2017 Tax Cuts and Jobs Act (TCJA) introduced significant reductions in individual and corporate income tax rates. Personal income tax rates decreased across several brackets, though the 35% and 10% brackets remained unchanged.

With President Trump’s re-election and Republican control of Congress, the TCJA will likely remain in place or be reformed to preserve its stimulative elements. Stability in tax policy may help reduce market volatility by providing greater certainty. However, since these tax cuts have been in effect for several years, their stimulative impact may diminish without further action.

During President Trump’s first term, tariffs played a significant role in his trade policy, aimed at reducing the U.S. trade deficit. For instance, the U.S. imposed tariffs on goods like steel and aluminum from China and renegotiated trade deals, including the United States-Mexico-Canada Agreement. Despite these actions, the U.S. trade deficit with China widened to a record $418 billion in 2018. Although U.S. imports from China fell by 24% between 2018 and 2019, the trade deficit remained substantial at $343 billion. This indicates that while tariffs may lower imports of specific goods, they often do not lead to a significant decrease in the overall trade deficit, as the U.S. continues to be a net importer.

Moreover, tariffs typically hinder economic growth by raising costs for businesses and consumers. While they may promote some domestic production and reduce imports in certain sectors, they can also have adverse effects on the economy. Tariffs can drive inflation, prompting higher interest rates as a countermeasure. This can increase borrowing costs and weaken consumer spending, further restricting economic growth.

The restrictive effects of tariffs during Trump’s first term were partially offset by the stimulative impact of tax cuts. Despite tariffs, the U.S. Dollar weakened by 12% in this period, suggesting that tax cuts may have had a greater influence on the economy than the tariffs’ restrictive effects, all else equal.

Ultimately, the net impact of tariffs on the economy will depend on how they interact with other fiscal policies. While tariffs tend to hinder growth, their effects may be mitigated by fiscal or monetary policies aimed at stimulating consumption and investment.

Despite lagging domestic equities, international equities could add future value to a diversified portfolio.

Diversifying equity investments across international markets may offer growth opportunities, currency diversification, and potential reduction in portfolio volatility.

Over the past decade, U.S. large-cap equities, particularly those that possess the greatest weights in the S&P 500, have significantly outperformed their international counterparts. In fact, U.S. equities have delivered 7.3% higher annual returns than international developed markets and 9.1% more than emerging markets.

Given this disparity, one might ask: Why invest internationally at all? The answer lies in the risks associated with sustained outperformance. Over time, maintaining high returns becomes increasingly difficult.

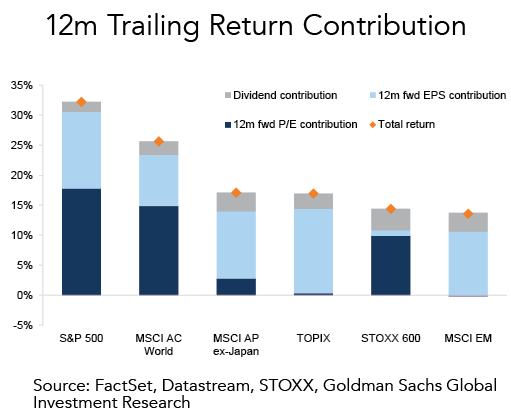

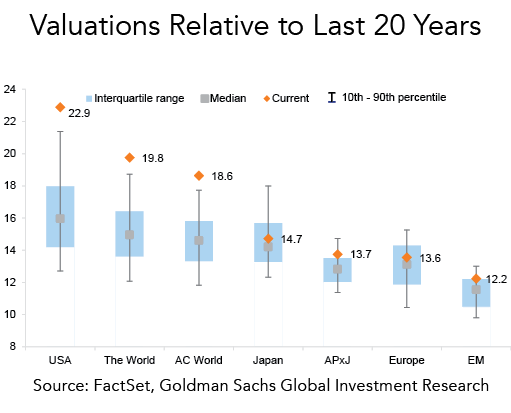

Recent data highlights this asymmetry. Over the past 12 months, roughly half of the S&P 500’s total returns were driven by multiple expansions—investors assigning higher valuations to earnings. In contrast, equities in Asia/Pacific and emerging markets remain priced in line with their earnings growth prospects. This valuation gap presents an opportunity for international equities to deliver positive surprises if macroeconomic conditions improve.

For investors concerned about high valuations in U.S. equity markets, international diversification offers a reasonable strategy to mitigate downside risks.

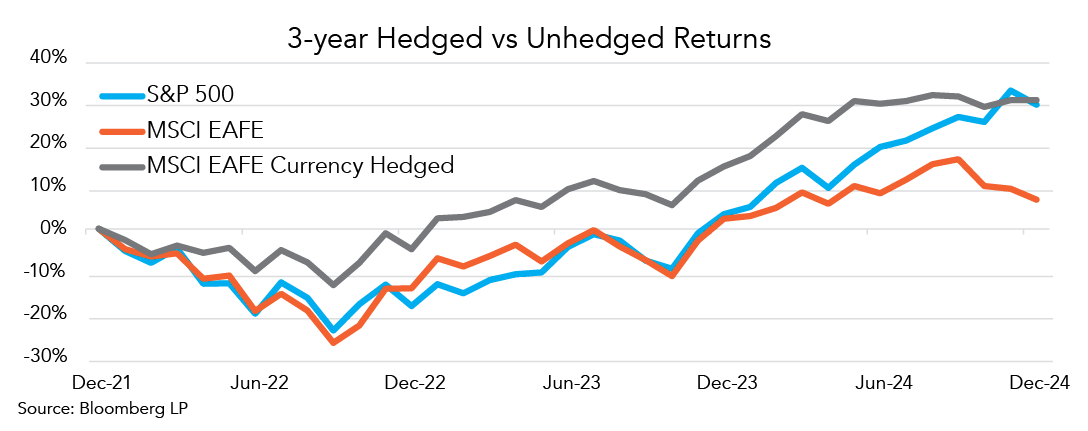

Currency diversification is a key benefit of international investments, offering a hedge against domestic currency depreciation. The U.S. Dollar has strengthened against developed market currencies, fueled by the robust U.S. economy post-pandemic and central bank rate hikes addressing inflation. For U.S. investors, this creates an opportunity. Currency-hedged portfolios of international equities, such as the iShares Currency Hedged MSCI EAFE ETF, have outperformed the S&P 500 by 0.29% annually since 2022.

As mentioned in the economics section, the extent and direction of the impact of changes in tax and tariff policies under the incoming Trump administration on the U.S. economy remain uncertain. These policies will influence interest rates, corporate profitability, and the demand for U.S. dollars.

If the dollar maintains its relative strength, domestic U.S. investors could continue to accrue the benefits of international diversification in terms of correlation and risk reduction while also capitalizing on the dollar’s strength within a currency-hedged portfolio. Conversely, if the dollar weakens due to decreased demand from higher-priced imports and its subsequent effect on corporate profitability, an unhedged portfolio might offer more value. The key takeaway is that having access to these options may be advantageous.

International diversification may provide significant value, even with the recent outperformance of U.S. equities. Investing in both developed and emerging market equities could reduce risk, unlock growth opportunities, and strengthen portfolios.

With U.S. equities trading at elevated valuations and international equities appearing undervalued, now may be an opportune time to consider expanding equity exposure across international markets. By diversifying investments and balancing hedged and unhedged strategies, investors may better position their portfolios for evolving global conditions.

Private markets provide investors access to unique opportunities, offering diversification and potential higher yields as fewer companies go public.

Private assets offer unique opportunities and diversification, potentially enhancing portfolio returns and yields for investors.

Private markets have historically been an elusive investment class that was not easily accessible. At their core, private markets involve investments in non-public assets that do not trade on exchanges like traditional bonds or stocks. These investments include equity, fixed income, real estate, and infrastructure, much like their public market counterparts.

Private markets exist partly due to the evolving landscape of public markets and the benefits companies gain by staying private longer. In 1996, there were over 7,000 publicly traded companies in the U.S.; by 2020, that number had dropped to less than 4,000. The long, cumbersome, and expensive initial public offering (IPO) process often deters companies from going public until they are larger, more established, or the IPO environment is favorable. Raising capital privately may take longer, but it offers distinct advantages. Private companies can focus on long-term strategic goals instead of short-term share price performance. Additionally, they face fewer regulatory burdens, such as quarterly filings with the SEC, and retain more control without public shareholders.

For investors, private market assets offer potential benefits such as lower volatility, higher returns, and diversification. However, there are drawbacks. Liquidity is limited, with lock-up periods lasting several years, depending on the fund structure. Management fees are higher than those of mutual funds or ETFs due to the complexity of assets and expertise required to manage them. Certain investments, like venture capital, carry significant risks due to the lack of proven track records. Diversifying across public and private markets may help mitigate these risks.

Private markets have evolved to offer more flexible opportunities for investors, though they still present certain barriers. Historically, private markets were limited to ultra-high-net-worth individuals, endowments, and pensions that could commit large sums and tolerate illiquidity. Traditional drawdown funds had lengthy lock-up periods with capital calls over years and exits in 5–10 years. Today, modern structures, like open-ended non-traded funds, offer more regular liquidity, with daily or monthly purchase options that address some inefficiencies – though liquidity is not always guaranteed.

Despite improvements, barriers remain. Some funds still require income, net worth, or investor qualifications. However, minimum investment amounts have decreased, broadening access to private markets. While these investments are not typically available through standard brokerage accounts, working with investment advisors or wealth managers may help investors navigate the landscape and understand the associated risks and rewards.

The years leading up to and including 2023 set the stage for significant growth in private credit. The private equity market, as previously discussed, had expanded substantially. One of its key financing sources, private credit funds, benefited from this growth. At the same time, a higher interest rate environment attracted investors seeking yields that exceeded those available in public markets. In March 2023, the failure of three major financial institutions triggered widespread panic and tightened bank lending standards, leaving many firms without access to traditional funding. Non-bank financial institutions stepped in to fill this void, offering higher-yielding floating and fixed-rate loans. These factors combined to drive the continued rise of private credit over the past year and a half.

Private credit is part of the broader private markets universe and differs significantly from traditional corporate bond funds. Many of the underlying companies are privately held, with many backed by private equity firms, although this is not always the case. Private credit lenders often have greater control over covenants and asset requirements than their public market counterparts. The loans made in this market are priced as a spread above a reference index like SOFR or T-bills, typically 4-7%. Like their public market counterparts, spreads widen and compress depending on the business cycle.

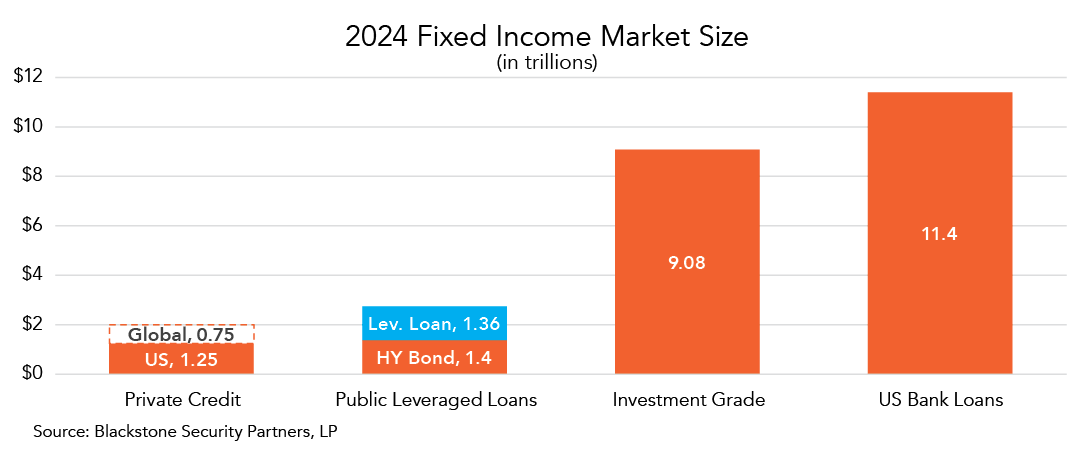

The rapid flow of capital into private credit has intensified competition among lenders, emphasizing the need for careful diversification and risk management. Spreads have narrowed despite concerns over economic conditions, and loan covenants have loosened compared to a few years ago. Diversification remains key to managing these risks. By investing in a variety of loan types and utilizing multiple private credit funds specializing in different sectors, investors may build a robust portfolio. While private credit has expanded at unprecedented rates, it is vital to remain mindful of its scale and the underlying risks associated with the asset class. Private credit accounts for roughly $2 trillion compared to investment-grade bonds and U.S. bank loans, which account for $9 and $11 trillion, respectively. This comparison highlights the scale and relative size of private credit within the broader fixed-income landscape.

Our team of dedicated professionals are here to support you.