Market Outlook Newsletter

2nd Quarter 2023

By Betsy Pierson, CFA

While the labor market continues to remain solid, the impact of tighter credit conditions may result in slower economic growth.

The anticipation of a slowing economy and a less aggressive Federal Reserve has led markets into positive territory this year. Volatility may continue, but long-term investors will benefit.

The long-awaited recession was still not evident during the first quarter. As long as people continue to remain employed and see increases in income, the economy will likely not slow as quickly as anticipated by the markets. Large mega companies have announced substantial cutbacks in staffing, but keep in mind they were the companies that increased employment significantly during the pandemic. As the world has normalized, the excessive demand for technology products has subsided. Small- and mid-sized companies that never reached full employment due to lack of workers are not in the position yet where they need to cut staff. In reality, those companies are just reaching a comfortable level of employment. According to the most recent JOLTS report, job openings remain at almost twice the number of unemployed. The pipeline appears to be softening, and the labor supply and demand are coming into better balance. A continued tight labor market may limit the severity or onset of a recession.

The run on bank deposits and the ultimate failure of Silicon Valley Bank (SVB) and Signature Bank of NY (SBNY) caused trauma across the financial system as bank depositors rushed to ensure funds were insured by the FDIC. The failures of these institutions were not a credit event but rather a liquidity issue. While it was not a credit issue, the increased need for funding by small- and mid-sized banks to cover potential outflows may result in less availability for lending. These financial institutions are the heart of small- and mid-sized business lending and if the availability of credit tightens, it may result in less business investment and future economic growth.

Fear of bank failures and economic recession led to a flight to quality in the investment markets. Investors searched for safety by increasing investments in treasury securities and the largest, most liquid stocks. Markets built in expectations that the Federal Reserve would potentially halt its fight against inflation despite still strong inflationary pressures. Fixed income returns had been in negative territory prior to the SVB collapse but rallied into positive territory before quarter end. The largest tech names with strong cash flow and low debt levels led the stock market higher as the quarter ended as well. Historically, this type of market action provides opportunities for long-term investors. Buckets of investments are often thrown out with the bath water when a crisis occurs. However, many of these investments still have extraordinary value and, in the end, provide a better investment opportunity over the long term.

FEAR OF BANK FAILURES AND ECONOMIC RECESSION LED TO A FLIGHT TO QUALITY IN THE INVESTMENT MARKETS.

Inflation numbers continue to remain at levels above where the Federal Reserve is targeting. There has been some relief from the elevated levels seen in mid-2022, but there are still pockets of inflation. Commodity prices were flat during the quarter after rising during January, declining through mid-March, but rising again heading into quarter end. Oil prices hit a low on March 20 with West Texas Intermediate Crude hitting $64.36 per barrel before rising to $75.67 per barrel as of March 31. Labor costs peaked late last year. A stabilizing market or softening labor market will help ease wage pressures for businesses, which should result in less pressure to raise prices to the end consumer. The Federal Reserve continues to put fighting inflation as its primary objective, although it realizes it may result in a recessionary environment. Slower demand during a recession typically leads to lower inflation.

Stocks both domestic and international did a 180 from last year’s whirlwind and posted positive returns to start the year.

We are still optimistic on the stock market as we continue to search for quality over the next few months.

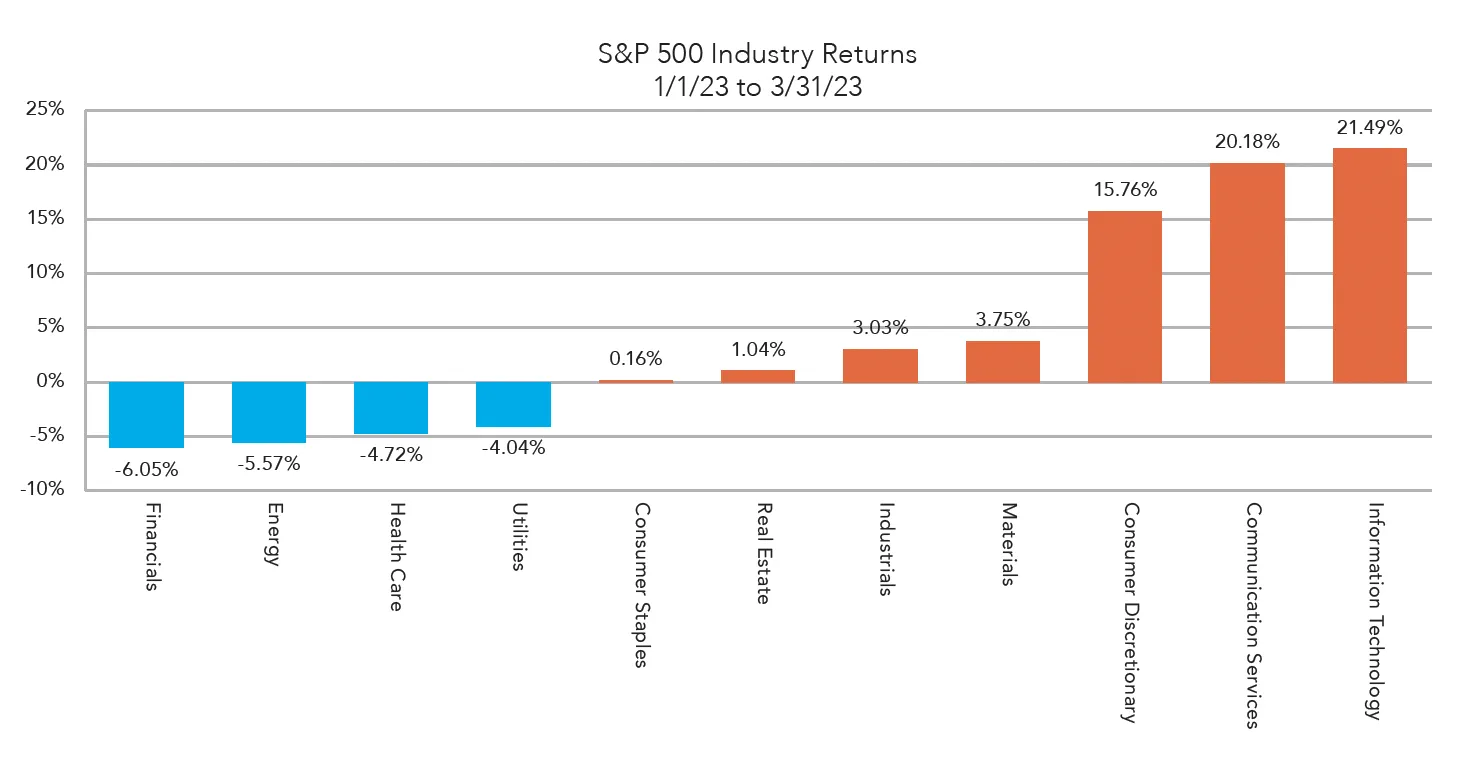

With one quarter down in 2023, the equity market is almost completely unrecognizable compared to the first quarter of 2022. The year prior the S&P fell 5.18% in the first quarter, but in contrast it climbed 7.46% this year. Seven of the 11 S&P 500 indices finished with positive returns this quarter. Discretionary, Information Technology, and Communications all posted double-digit gains. The Nasdaq composite rose 17.67% while the Dow had a modest gain of 0.4%. With inflation showing signs of cooling, many are hopeful that the Fed is reaching the end of its rate hike cycle. However, statements made by Boston Fed President Susan Colins that inflation data will not change the Fed’s rate path may create uneasiness for some investors. We can likely expect another 0.25% increase in May.

Unsurprisingly, financials took the biggest hit last quarter. The fallout from the Silicon Valley Bank (SVB) failure led to heightened consumer fears of potential bank runs and future bank failures. SVB marks the second-largest failure in U.S. banking history. Only the Washington Mutual (WaMu) collapse in 2008 was larger. SVB was the 16th largest bank in the country and provided services to nearly 50% of all Technology and Life Sciences companies in the U.S. Nearly 94% of SVB’s deposits were uninsured – the second highest percentage among all U.S. banks. The tech boom in prior years led to massive increases in deposits, causing them to grow 191% over a two-year period from $65B to $189B.

During the low interest rate environment, SVB invested nearly 95% of its deposits in 10-year hold-to-maturity (HTM) securities. The crisis began when the tech boom slowed, and many SVB clients started drawing on their deposits to stay afloat. The swift withdrawal of funds required SVB to sell off securities, and the rapid rise in interest rates left the HTM securities depressed in value. The buildup of ineffective asset and liability matching led to the eventual failure of the bank. The Dow Jones U.S. Bank Index fell 13.12% over the last quarter. The failure sent a ripple through many areas of the economy.

WITH INFLATION SHOWING SIGNS OF COOLING, MANY ARE HOPEFUL THAT THE FED IS REACHING THE END OF ITS RATE HIKE CYCLE.

Embedded in the communication services run last quarter was a 30% increase in Interactive Media and Services. Meta Platforms (META), Rumble (RUM), and Cars.com (CARS) had returns of 76.12%, 68.07%, and 40.16%, respectively. Layoffs and cost cutting were common themes in the technology sector last quarter. For example, Meta laid off 10,000 employees and removed 5,000 open job postings. The improving margin conditions still haven’t convinced investors to update the industry outlook as most stocks are still neutral overall. Even with the massive run, current P/E ratios of 26.3x for the technology industry remain below the 3-year average of 28.5x.

The first quarter has come to a close and interest rates are still moving higher. However, an end to the tightening cycle may be near.

We maintain the belief that most of the rate increases are behind us. Ultimately, the Fed will adjust to incoming data, and we just witnessed how quickly the environment can change. The Federal Reserve had two meetings during the first quarter, which resulted in two more rate increases. The rate increase in December was 0.50% and true to their word, the pace of the Fed’s rate increases has slowed since then. The rate increase in both February and March was 0.25%. This puts the current fed funds rate at 4.75% to 5%.

The economy has been more resilient to these rate increases than expected. However, two highly publicized bank failures and a crisis of confidence have demonstrated that higher interest rates are having an effect on the economy.

Our investment strategy committee will continue to review and monitor the current investment environment and pay close attention to the Federal Reserve statements. What they say is just as important as what they do. The next Federal Reserve meeting will occur on May 3. Inflation remains elevated but does continue to ease. Headline CPI inflation has eased from a peak during the summer of 9.1% year-over-year to the most recent reading of 6.0%.

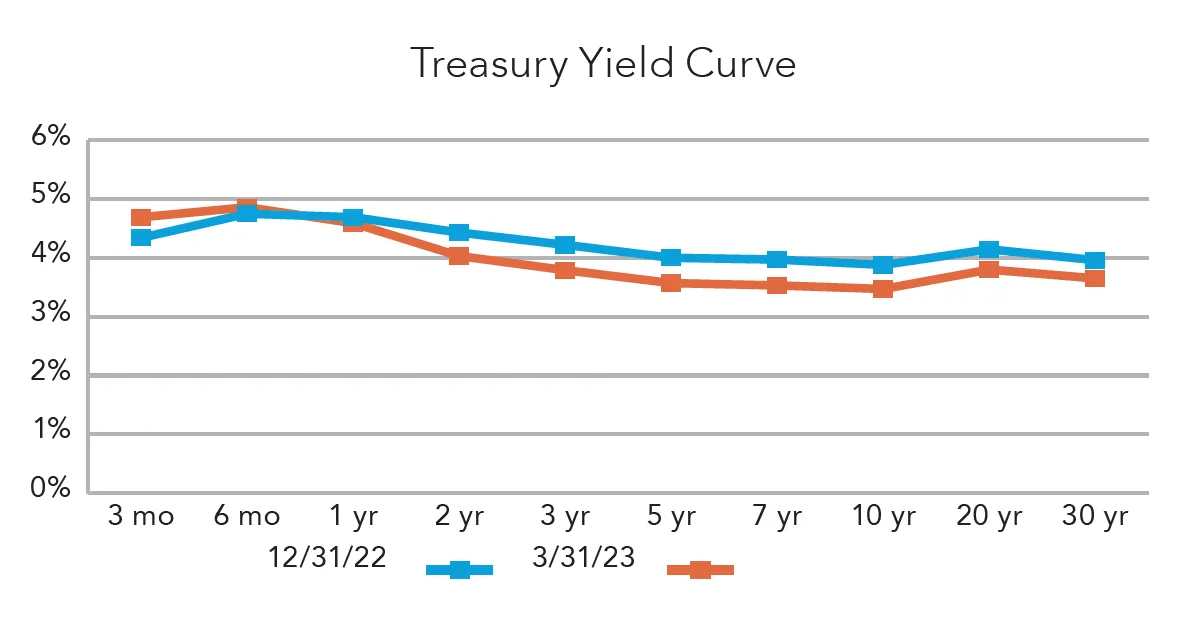

The yield curve remains inverted, and treasury rates had a volatile first quarter. The 2-year Treasury started the quarter at 4.40%, peaked late in the quarter above 5%, and settled at 4.06% by quarter end. The 10-year yield started the quarter at 3.79%, peaked above 4%, and settled at 3.48%.

Analysts anticipate that the Fed will stop raising interest rates at some point in 2023 and expect the terminal or peak rate to be 5 to 5.25%. We are almost there, but again, much depends on how rate hikes impact the economy.

It is a welcome relief to see positive performance in bonds. The first quarter fixed income performance is as follows:

Our investment strategy committee adjusted our current target allocations and rebalanced portfolios late in the first quarter. With the elimination of our alternative investments, we moved closer to a neutral position to fixed income but kept an elevated cash position. We also made moves to increase fixed income credit quality.

By Patricia Fong, JD, CTFA, CAP®

A giving legacy can help fulfill your philanthropic goals.

Many of us think that only people like Warren Buffet or Bill Gates can establish a foundation or use charitable vehicles to support their favorite charities. You don’t need millions of dollars though to be a philanthropist.

Recently, I met a group of women who were members of a local church, a recipient of funds helping to support it over the last 25 years. This plan started out with five sisters, who never married, nor had children, and all lived together. They were frugal, saving money and incurring no debt. One by one, they passed away. By the time I met with the remaining three sisters, one was nearing the end of her life and said to me, “Please watch over my sisters.” With that direction, I helped the last two sisters with their financial and estate goals using a few different tools. They were intent on leaving any remaining assets after they died to a family foundation that was created under the terms of their trust. The income in perpetuity was to be split 50% to their church and 50% to a charity they were passionate about. The trust started out with roughly $1 million, has since more than doubled, and continues to pay out the net 5% income distribution to the church and charity in the amount of about $50,000 each. The group of women I met were amazed that their church continues to receive support like this allowing their church to survive.

If you’re considering legacy planning, ask yourself these questions to get started:

Once you gather your ideas and interests in philanthropy, share your thoughts with an experienced Trust Officer or CERTIFIED FINANCIAL PLANNER™ professional to help incorporate your goals and vision into your wealth plan.

Our team of dedicated professionals are here to support you.