Market Outlook Newsletter

3rd Quarter 2023

By Betsy Pierson, CFA

The long-awaited recession has not yet arrived. Economic and market indicators have investors wondering if the Federal Reserve has achieved a soft landing.

Despite the Federal Reserve Open Market Committee (FOMC) increasing short-term rates by 5% over the last 15 months, the U.S. economy continues to show resilience. However, a recession is still possible with continued FOMC rate increases.

Economic releases have been stronger than expected. The Citi Economic Surprise Index measures data surprises relative to market expectations. If the number is below zero, the economy is not meeting expectations, and if the number is above zero, expectations are being exceeded. The current data demonstrates the economy is stronger in many cases than expected.

The housing market has continued to show resilience with an emphasis on new home sales. The inventory of existing homes available for sale remains very low. This is not surprising because few homeowners are eager to sell due to a “mortgage lock-in” phenomenon, after buying or refinancing at much lower rates before 2022. The supply of completed new single-family homes has more than doubled since the bottom in 2022, leading to a decline in the median sales price of new homes by 16% from the peak late last year but has trended upward recently.

The U.S. economy continues to create new jobs with the most recent report showing an increase of 339,000 during May, and the jobs openings remain high at over 10 million. While these appear to be strong numbers, some behind-the-scenes reports do not appear as positive. The weekly jobless claims have increased from under 200,000 per week to the mid-200,000 level. The average hours worked and the number of temporary workers have declined in the most recent reports, which may indicate a slowdown in the labor market. Continued monitoring of this is warranted.

WE MAY SEE SLOWER GROWTH IN THE SECOND HALF OF THE YEAR, BUT THE CONSUMER CONTINUES TO SPEND AND IS EMPLOYED.

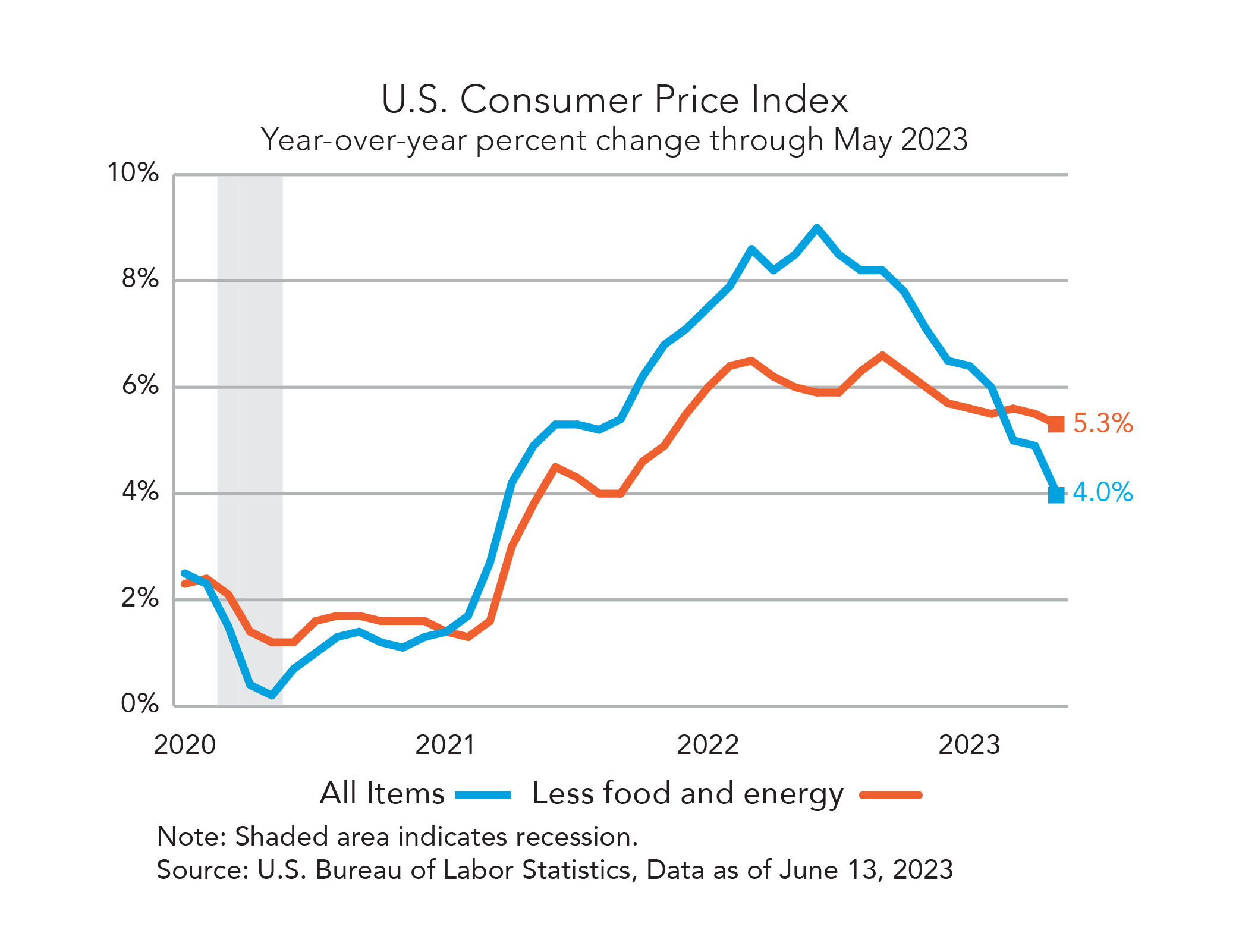

Inflation numbers remain at levels above where the FOMC is targeting, and the FOMC continues to put fighting inflation as its primary objective. However, the level of inflation has declined dramatically from June 2022 when CPI year-over-year peaked at 9.1%. If we see a neutral inflation number in June 2023, the CPI year over year will be in the 3% to 4% range. While the overall CPI has continued to decline, the Core CPI continues to be sticky. It hit its peak in September 2022 at a 6.6% level, and the most recent reading was 5.3%, which is much higher than the FOMC would like to see. The consumer is still feeling the pain of higher food and energy costs, but the dramatic increase in those prices has stabilized at these higher levels. The areas where the economy now sees continued pressure are insurance, services, travel, etc. The cost of homeowners and auto insurance is increasing substantially during 2023. This makes sense because those premiums are typically determined once a year, and insurance companies are just catching up to the dramatic upward shift in pricing last year. In addition, the demand for travel continues to be strong as consumers take trips that were postponed during COVID. A substantial amount of pent-up demand leads to higher prices. There will be sticker shock during 2023 for many of these services, but like food and energy, we should see less pricing pressure heading into 2024. At that point, Core CPI should be less sticky and follow CPI lower over the next year. The issue will be getting these numbers closer to the FOMC target of 2%. The FOMC will remain vigilant and is expected to increase rates potentially two more times this year.

The strong equity market, resilient housing market, and continued strong level of employment have resulted in the average consumer feeling wealthier and more positive. This may put a floor on the growth rate of the economy in the near term. The FOMC will not directly state that the upward move in the equity market is a concern, but the rhetoric that it needs to be vigilant and ready to increase rates certainly is influenced by it to some extent. We may see slower growth in the second half of the year, but the consumer continues to spend and is employed. Maybe the Fed did achieve the soft landing, which is a difficult thing to do. In the meantime, we will continue to monitor the markets and the economy and focus on investors’ long-term goals as we move forward in our investment decisions.

Midland Wealth Management is a trade name used by Midland States Bank, Midland Trust Company, and Midland Wealth Advisors, LLC, a registered investment advisor. Investments are not insured by the FDIC or any other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank or any federal government agency, and are subject to risks, including the possible loss of principal. The information provided is for informational purposes only. Information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed. Midland Wealth Management does not provide tax or legal advice. Please consult your tax or legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. IRS CIRCULAR 230 NOTICE: To the extent that this message or any attachment concerns tax matters, it is not intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Past performance is no guarantee of future results. Returns of the indexes also do not typically reflect the deduction of investment management fees, trading costs or other expenses. It is not possible to invest directly in an index. Indexes are the property of their respective owners, all rights reserved. Midland Wealth Management does not claim that the performance represented is CFA Institute, GIPS, or IMCA compliant. Copyright © 2023 Midland States Bancorp, Inc. All rights reserved. Midland States Bank® is a registered trademark of Midland States Bancorp, Inc.

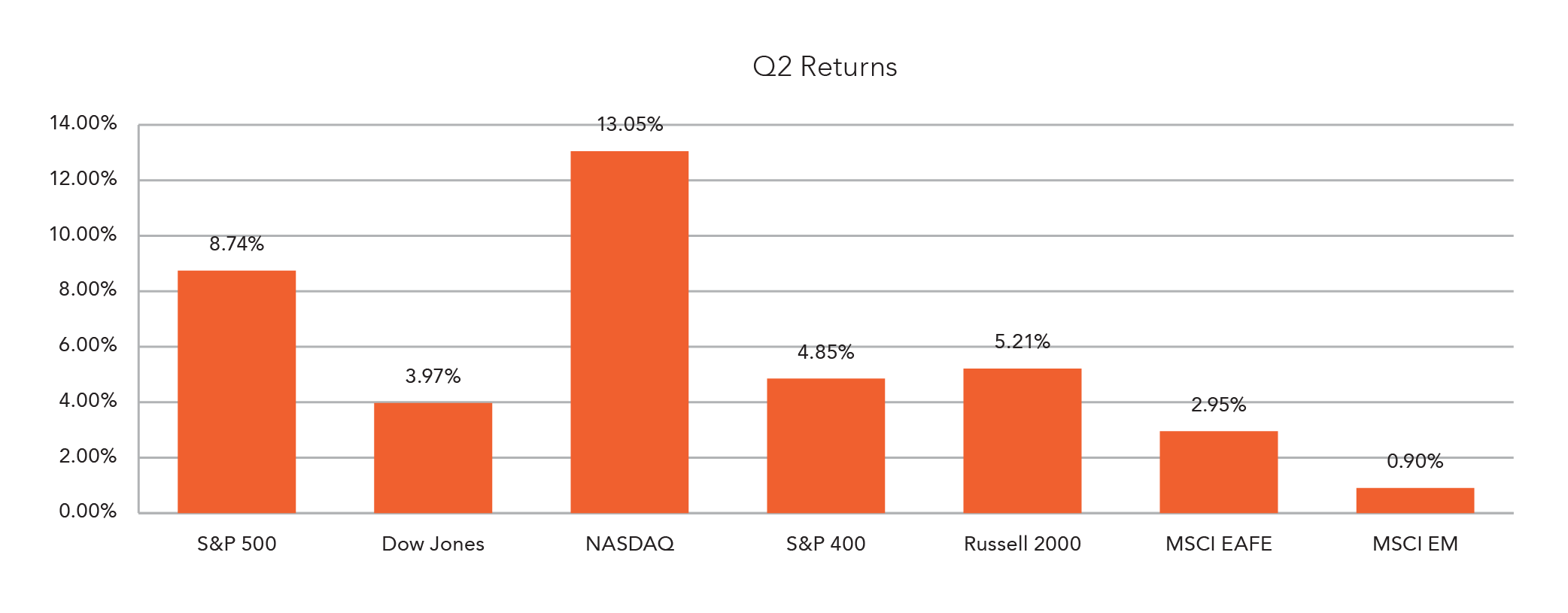

The S&P 500 reached a 52-week high, predominantly being pushed by mega cap companies.

We maintain our defensive position within the portfolio. However, we are more neutral on the market’s outlook over the next 6 to 12 months.

Much like the first quarter, the S&P 500’s returns have been positive with the communication services and information technology sectors up 12.82% and 16.93%, respectively. Another sector that should not go unnoticed is consumer discretionary, which was up 14.31% for the quarter. The gain was driven by automobiles, leisure products, and broadline retail. It appears the American consumer is still spending. In the first quarter alone, spending rose 4.2%, the highest level since the second quarter of 2021. Consumer confidence is at its highest since early 2022, although nowhere near the pre-COVID high. Consumers do not appear as nervous about a recession as the experts do. When you look at the average savings rate over the last 20 years, consumers are saving far less, roughly 4.1% in April, compared to the 6.8% average. Some decreases may be due to inflation, but it’s worth noting that nearly 68% of Americans have a vacation planned, and vehicle sales are above the 20-year monthly average of 15.6 million units. It’s spending like this that explains the returns of companies such as Ford, GM, eBay, and Nordstrom.

Nvidia was momentarily one of five companies in the S&P 500 with $1 trillion in market cap. Increased revenue guidance to $11 billion and a massive demand for chips caused the stock price to increase more than 44% to an all-time high of $439.90 per share. However, most valuation experts are concerned that the current pricing could represent a 15-25% overvaluation. Based on the current outlook for the chip industry, that overvaluation represents Nvidia’s ability to have zero hiccups in its stated guidance and capture almost all future chip revenue and growth. Its stock price is already dropping as potential legislation could impact the company’s long-term performance, such as a possible ban on AI chips to China. While Nvidia’s CFO stated a ban would not affect near-term performance, a continual ban on chips could dampen future performance and cash flows for the firm. Post announcement, the security price fell 2%. Only time will tell if Nvidia’s current price can sustain further legislation.

CONSUMERS DO NOT APPEAR AS NERVOUS ABOUT A RECESSION AS THE EXPERTS DO.

Foreign equities have been providing mixed signals over the last few years. On one hand, the rolling 3-year S&P 500 return has beaten the MSCI EAFE developed markets index for the past 53 quarters, marking the longest consecutive outperformance in the history of the indices. On the other hand, European valuations are at the lowest levels seen across a 15-year average. Unsurprisingly, a culmination of issues has pushed returns lower. Meanwhile, here in the U.S., we are seeing record prices, high consumer spending, and S&P 500 companies reporting positive first quarter earnings and revenue. The historically low valuations of international equities have caught the attention of many investors. We currently maintain a slight overweight to international equities in our portfolios. While consistent international equity outperformance isn’t expected soon, low international stock valuations and improving economic conditions promote the case for maintaining international exposure.

The second quarter has ended, and short-term interest rates are still moving higher. Year-to-date fixed income maintains positive performance.

We believe that most of the rate increases are behind us. Two FOMC meetings during the second quarter resulted in a rate increase of 0.25% in May and a pause announced in June. After the June meeting, Jerome Powell comments suggest another 0.50% or two 0.25% rate increases this year. The current fed funds rate stands at 5.00%-5.25%.

The debt ceiling agreement seems like a distant memory, but was resolved without a lasting, significant disruption to the bond or equity markets. The nation’s debt limit has been suspended until January 1, 2025.

The first quarter GDP was recently revised higher. The previous estimate was 1.3%, but now shows a 2% annualized pace. The bottom line is consumers are still spending and one reason is because they have jobs. The labor market continues to be strong with the unemployment rate currently at 3.7%.

Inflation is heading down but remains elevated. The Federal Reserve still views their number one priority as reducing inflation further. The consumer price index increased 4.0% year-over-year, which is in line with expectations and the lowest level in about two years. We expect this to trend towards 3% by year-end.

The yield curve remains inverted. Comparing rates through the first half of the year, the 2-year Treasury has moved higher, but the 10-year remains relatively stable. The current 10-year Treasury rate of 3.84% is below its historical average.

It is estimated that the lag effect of raising interest rates is 9-12 months. The rate increase pause gives the FOMC a chance to monitor conditions. We could see rate increases at the July and September meetings. After the perceived final rate increase of a cycle, analysts typically discuss rate cuts. Lowering rates too soon would have negative consequences for the economy, so we do not expect any cuts this year.

Bonds have held their positive performance through the first half of the year while also providing their signature stability. Year-to-date fixed income performance is as follows:

We maintain an elevated cash position and a slight underweight to fixed income. Our duration has moved out and respectable interest is being earned. With rates moving higher, now is a great time to revisit interest rates on checking and savings accounts! Be sure your money is working for you.

By Patricia Fong, JD, CTFA, CAP®

Charitable giving is a great way to help save on income taxes, maximize your impact on a charitable legacy you hold dear to your heart, and potentially help minimize death taxes.

According to the Women’s Philanthropy Institute, their report found that giving to charity increased by 9.3% during the COVID pandemic. Giving is still a major component of most people’s financial plans but they’re taking note of doing it more strategically.

The following options can help match an individual’s giving strategy during his/her lifetime:

Charitable giving may be useful in your personal situation. Be sure to talk with your advisor including your tax consultant to see what the best option or two may be for you.

Our team of dedicated professionals are here to support you.