Refer your friends and earn up to $500. Refer Today

Checking for Your Brightest Moments

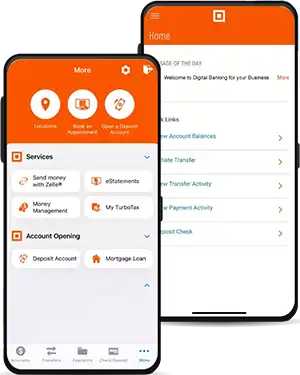

We like to help you keep more of what's yours by including free digital banking, free eStatements, and free bill pay with every new checking account.

Open a qualifying checking account, take home a free Cylo Tower Speaker, and earn $10 when you trade in checks or a debit card from another bank.¹

| Feature | Totally Free Checking | 50+ Interest Checking | Direct Interest Checking | High Yield Checking |

|---|---|---|---|---|

| Minimum Opening Balance | $50 | $50 | $50 | $50 |

| Monthly Service Charge | $0 | $0 | $0 | $0 or $10 |

| Minimum Balance to Earn Interest | N/A | $0.01 & up | $0.01 & up | $0.01 - $1,499.99 |

| Balance to Earn Premium Interest | N/A | N/A | N/A | $1,500 & up |

| Free Standard Checks | N/A | 1 Box Annually | N/A | Unlimited Free Checks |

| Key Features & Benefits |

|

|

|

|

| Open Account | Open Account | Open Account | Open Account |

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 |

| Minimum Balance to Earn Interest | N/A |

| Balance to Earn Premium Interest | N/A |

| Free Standard Checks | N/A |

| Key Features & Benefits |

|

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 |

| Minimum Balance to Earn Interest | $0.01 & up |

| Balance to Earn Premium Interest | N/A |

| Free Standard Checks | N/A |

| Key Features & Benefits |

|

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 or $10 |

| Minimum Balance to Earn Interest | $0.01 - $1,499.99 |

| Balance to Earn Premium Interest | $1,500 & up |

| Free Standard Checks | Unlimited Free Checks |

| Key Features & Benefits |

|

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 |

| Minimum Balance to Earn Interest | $0.01 & up |

| Balance to Earn Premium Interest | N/A |

| Free Standard Checks | 1 Box Annually |

| Key Features & Benefits |

|

I keep saying over and over and over again. Great bank, great people, friendly, easy-to-use website. I wouldn’t bank anywhere else.Maher, Customer for 11 Years

Banking by app has been a great experience. I am handicapped and unable to get out. Every time I call the office, I get excellent service.John, Customer for 24 Years

Great convenience. It is easy to pay my monthly bills online. I like the mobile app which makes it easy to check balance, deposit checks, make transfers between accounts, and review withdrawals.Terry, Customer for 28 Years

What Do You Need to Open a Bank Account?

Whether you're starting your first account or adding a new one, knowing what you need to open a bank account can save you time and hassle. Here's what you need to get started.

What Do You Need to Open a Bank Account?

Whether you're starting your first account or adding a new one, knowing what you need to open a bank account can save you time and hassle. Here's what you need to get started.

Do Checking Accounts Earn Interest?

Did you know checking accounts can help grow your money? Let’s break down how and when you can earn interest from your checking account.

Do Checking Accounts Earn Interest?

Did you know checking accounts can help grow your money? Let’s break down how and when you can earn interest from your checking account.

Our team of dedicated professionals are here to support you.

1 Cylo Tower Speaker or gift of similar value may be reported on a 1099-INT or 1099-MISC; if unavailable, gift will be substituted. Branch accounts receive the gift at opening; accounts opened online will have the gift mailed to the address on file. The minimum opening balance required to open a checking account is $50.

$10 for debit cards and unused checks from another financial institution given at the time the checks/debit cards are presented.