Earn Higher Interest with $1,500 or More

A checking account for those interested in earning higher interest.

Unlimited free standard checks

Higher interest rate with a balance of $1,500 or more

Competitive interest if balance falls below $1,500

Only $10 monthly charge if minimum balance falls below $1,500

Every new checking account includes a free Mastercard® debit card that includes features including but not limited to*:

Need a new debit card fast? Get a replacement instantly at any Midland location—whether it’s lost, damaged, or you just need one right away

With integrated card controls, you decide when, where and who uses your cards. Turn your cards on or off, set spending limits and get alerts, all from your mobile device.

Checking accounts are insured by the FDIC up to the maximum coverage allowed.

| Feature | Totally Free Checking | 50+ Interest Checking | Direct Interest Checking | High Yield Checking |

|---|---|---|---|---|

| Minimum Opening Balance | $50 | $50 | $50 | $50 |

| Monthly Service Charge | $0 | $0 | $0 | $0 or $10 |

| Minimum Balance to Earn Interest | N/A | $0.01 & up | $0.01 & up | $0.01 - $1,499.99 |

| Balance to Earn Premium Interest | N/A | N/A | N/A | $1,500 & up |

| Free Standard Checks | N/A | 1 Box Annually | N/A | Unlimited Free Checks |

| Key Features & Benefits |

|

|

|

|

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 |

| Minimum Balance to Earn Interest | N/A |

| Balance to Earn Premium Interest | N/A |

| Free Standard Checks | N/A |

| Key Features & Benefits |

|

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 |

| Minimum Balance to Earn Interest | $0.01 & up |

| Balance to Earn Premium Interest | N/A |

| Free Standard Checks | 1 Box Annually |

| Key Features & Benefits |

|

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 |

| Minimum Balance to Earn Interest | $0.01 & up |

| Balance to Earn Premium Interest | N/A |

| Free Standard Checks | N/A |

| Key Features & Benefits |

|

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 or $10 |

| Minimum Balance to Earn Interest | $0.01 - $1,499.99 |

| Balance to Earn Premium Interest | $1,500 & up |

| Free Standard Checks | Unlimited Free Checks |

| Key Features & Benefits |

|

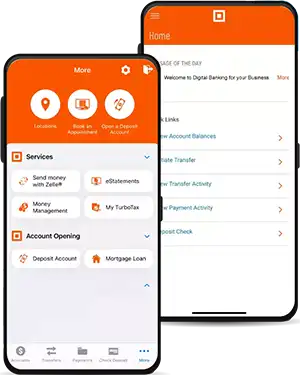

Easy online banking app. No need to go to a branch to deposit checks anymore.Angela, Customer for 8 Years

The people there go well beyond the call of duty to help!Anthony, Customer for 23 Years

The app is very user friendly and easy to get simple banking done. Also the fraud alert texts and calls are the most amazing feature of your bank!Kyle, Customer for 18 Years

Make the simple switch today. Enjoy the rewards tomorrow.

Other fees such as non-sufficient funds, overdraft, sustained overdraft fees, etc. may apply. See fee schedule for details. Minimum opening deposit is only $50. Ask us for details. Bank rules and regulations apply. Any offered gifts, sweepstakes winnings, or rewards may be reported on a 1099-INT or 1099-MISC. $10 for debit cards and unused checks from another financial institution given at the time the checks/debit cards are presented.

*Certain terms, conditions, and exclusions apply. See your Guide to Benefits for more information. All benefits provide secondary coverage only. Not available for Health Savings Debit Cards.

¹ For Promotional Offer: Promotional period ends May 23, 2025. Gift card provided electronically within 2 business days after account opening. Gift may be reported on a 1099-INT or 1099-MISC. $10 for debit cards and unused checks from another financial institution given at the time the checks/debit cards are presented. The minimum opening balance required to open a checking account is $50.

²Benefits are subject to terms, conditions and limitations, including limitations on the amount of coverage. Coverage is provided by New Hampshire Insurance Company, an AIG company. Policy provides secondary coverage only.

Our team of dedicated professionals are here to support you.